Effective CIP Accounting for Modern Construction Projects

Therefore, the construction in progress is a non-current asset account that keeps a record of all the costs incurred until completion. Construction auditors must adhere to the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) guidelines. The basics of accounting for construction companies also https://www.instagram.com/bookstime_inc include revenue recognition and cost allocation.

CIP vs. WIP Accounting

This flexibility enables businesses to scale efficiently while receiving tailored https://www.bookstime.com/ financial strategies. It’s an ideal solution for companies looking to optimize their financial management. Imagine Business a plans to expand its office building to accommodate more employees. Their accountant initiates a Construction-in-Progress Office Expansion asset account to document construction expenses. However, the inclusion of all assets, regardless of their current usability, is crucial for a balance sheet’s accuracy. This necessity becomes particularly evident when considering construction work-in-progress assets.

The Critical Role of Construction CPAs

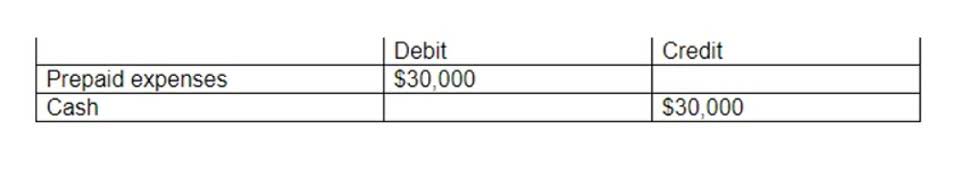

- Below, we’ll show you an example of what the recording may look like for a company.

- As it goes, small construction companies rarely hire experts to track and record their transactions.

- However, the term ‘ construction under process’ is used when the company is making construction contracts.

- A construction contract is a specific contract negotiated to build a fixed asset or group of interrelated assets.

- The opening WIP balance is added to the costs incurred during the period to determine the total WIP costs.

- With various teams working on different projects, ensuring that everyone is on the same page can be challenging.

Additionally, it explores the process of transferring the costs from the construction in progress account to fixed asset accounts to ensure proper asset recognition and depreciation. Accurate financial reporting is of utmost importance in the construction industry. It plays a critical role in ensuring financial transparency and enabling construction companies to make informed business decisions. By providing precise and reliable financial data, accurate financial reports facilitate effective construction financial management and contribute to the overall success of construction projects. Effective construction cost tracking is a crucial aspect of construction in progress (CIP) accounting, which is essential for accurate debit and credit management. By accurately monitoring and managing costs, construction companies can achieve better cost control, improve project management, and make informed financial decisions.

- CIP accounts are established to track and monitor the initial costs incurred during this stage.

- CIP accounting is important because it can easily be used to manipulate financial statements.

- Companies might be tempted to delay transferring costs from these accounts to other asset categories, thereby artificially inflating profits.

- Construction-in-progress (CIP) accounting is the process accountants use to track the costs related to fixed-asset construction.

- This technique works because construction projects are way more complex than other projects.

- Construction Work-in-Progress is often reported as the last line within the balance sheet classification Property, Plant and Equipment.

Why Do You Need a CIP Account Management Software like eSub?

Upon project completion, the CIP account is transitioned to the appropriate fixed-asset account. One thing to understand is that only capital costs related to an asset under construction are to be kept in the CIP account. The operating costs related to a specific period must be charged to the same accounting period. The IAS 11 construction contract is a comprehensive document dictating the complete accounting for construction in progress. Fixed assets, which are also called property, plant and equipment, go through a few stages in their life at any enterprise.

Depreciation Expense Account Vs. Allowance for a Depreciation Account

- You should pre-screen CIP-related invoices when they are first entered into the system, so that items to be expensed are charged off at once.

- Such detailed records enable construction firms to closely track cash outflows, analyze expense trends, improve decision-making, and enhance audit readiness.

- As costs are incurred, the CIP asset account is debited and accounts like cash, payables etc are credited.

- The appropriation of revenues and expenses should be made in the relevant accounting period according to the work’s percentage completion.

- The company will open the account Construction Work-in-Progress for Warehouse Expansion to accumulate the many expenditures that will occur.

It is worth noting that, despite the use of different modes of transportation, all are covered under a single Multimodal Bill of cip accounting term Lading, and the seller paid the entire transportation cost. The seller also arranged insurance for the goods under Clauses ‘A’ of Institute Cargo Clauses covering them up to Beijing, China. The key difference when comparing CIP and CIF lies primarily in the place of delivery and the modes of transportation each Incoterm® is designed for.

- That’s why most companies often hire a CFO to manage their accounts and ensure their finances are clean and error-free.

- These extras make CIP or construction in progress accounting relatively more complicated than regular business accounting.

- Given the complexities involved, many businesses opt to enlist the services of a chief financial officer (CFO) to oversee these records.

- A new publication providing clarity and practical support to those in the transport sector working on transactions involving the Incoterms® rules.

- Whereas, if the account appears under the heading of ‘Inventory and assets,’ it is probably a ‘build to sell’ asset.

- The purpose of CIP accounting is to provide transparency into the financial performance of ongoing construction projects.

- After the asset is completed, depreciation is calculated and recorded on the income statement.

Construction work in progress definition

CIP accounting also enables businesses to accurately report the value of their construction projects in their financial statements. In conclusion, construction-in-progress accounting is essential for effective construction financial management. The construction in progress accounting process covers the entire construction project lifecycle, from inception to completion. CIP accounts play a vital role in tracking and managing construction costs at each stage, providing valuable insights into project financials. By effectively utilizing CIP accounting, construction companies can ensure accurate financial reporting, better cost control, and informed decision-making.